- 简体中文

-

Scan and open an account free of charge

What is a CFD

Contract for difference (contract for difference) is a relatively new and flexible financial derivatives trading tool, referred to as CFD in English, currently can be traded on stock exchanges in 7 countries. Investors buy and sell at the price of a certain commodity, and do not involve the transaction of the commodity entity. CFD includes multiple financial markets such as stock indexes, foreign exchange, futures, and precious metals.

The underlying of CFD

(stock + commodity + stock index)

- apple, google 、 amazon, facebook 、 wal-mart, coca-cola, alibaba, jingdong and other dow components and chinese premium concept stocks.

- Tencent, HSBC, Sun Hung Kai, Xiaomi, Meituan, HKEx, Changhe and other high- quality Hong Kong stocks

- China Ping An, China Merchants Bank, Guizhou Moutai, Vanke Real Estate, Yanghe shares, Shanghai Automobile and other high-quality Chinese stocks

- crude oil, gold, silver, copper, Bitcoin and other commodities

- S & P, Dow, German, Hang Seng, Shanghai and Shenzhen 300 and other major global indices

The world is full of grass, why single love A stocks flower

Commodity CFD

CFD characteristics

Low transaction costs

No need to pay stamp taxes, settlement fees, regulatory fees, payment fees and other taxesMargin trading system

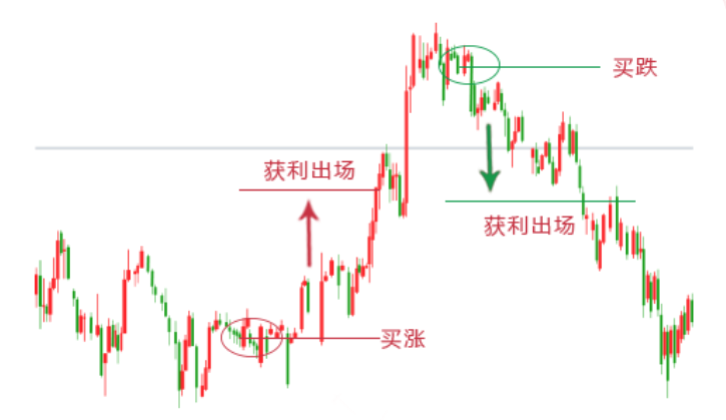

CFDs use margin to trade, which means that you only need to invest part of the amount to get the full position value. For example, Apple stock is now 450 US dollars per share, and you need to buy 100 shares in the traditional market for 45,000 US dollars. If the margin ratio is 5 %, you only need to pay 45000/20=2500 US dollars to establish a position of 100 shares of Apple stock.T+0 trading mechanism, multiple trades

There are no restrictions on opening and closing positions within a day, even if it is a three-minute advance game, it can be played immediately after three minutes, regardless of the number of times.68 T+0 trading mechanism, multiple trades

Flexible trading hours

The world is a 24-hour uninterrupted trading market. Traders in different time zones around the world can trade at any time and are not restricted by fixed trading hours. Whether you are in New York, London, Shanghai, Tokyo, or Paris, you can do it anytime, anywhere Trade via computer, mobile phone, ipad.

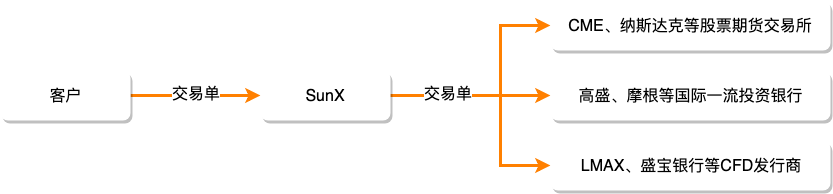

SunX's CFD trading model

SunX CFD is an ECN trading model. SunX puts all customer orders into the international market for trading. It does not participate in transactions and bets with customers. That is, whether the customer's profit or loss is related to SunX, the company only earns low commissions. Clients Trading Orders Sunx Trading Orders CME, Nasdaq and other stock and futures exchanges Goldman Sachs, Morgan and other world-class investment banks LMAX, Saxo Bank and other CFD issuers

CFD profit and loss calculation

(Profit or loss) = (closing price-opening price) * contract size * number of lots

E.g:

The current price of Tencent's stock is 400 Hong Kong dollars per share, 1 lot is 100 shares, you buy 3 lots, and your closing price is 390 yuan

Profit = (390-400) *100*3 = -3000 HKD (loss 3000 HKD)

Another example:

The current price of Tencent shares is 400 Hong Kong dollars per share, 1 lot is 100 shares, you buy 3 lots, and your closing price is 450 yuan

Profit = (450-400)*100*3=15000 HKD